foreign gift tax return

Consulting and Scalable Services to Help Businesses with Foreign and International Taxes. The tax applies whether or not the donor.

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

It is the annual limit for the exclusion of gift tax.

. Form 3520 is not a Tax Form. Therefore the IRS requires the recipient US. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Persons and executors of estates of US. Internal Revenue Code Section 6039F requires certain US Persons to report large gifts inheritances and foreign trust distributions from.

If the donor of the gifts is a nonresident alien individual or foreign estate and the aggregate value of the gifts that the US. Owner of a foreign trust is subject to a. Check the box if you are married and filing a current year joint income tax return and you are filing a joint Form 3520 with your spouse.

Ad Helping Businesses Navigate Various International Tax Issues. Important Practice Tip If you receive a gift. Person other than an organization described in section 501c and exempt from tax under.

There is no specific IRS taxes on gifts received from a foreign person. Learn How EY Can Help. The donor is required to file a gift tax returns when then annual gift made to any person during the year does not exceed 15000.

Decedents file Form 3520. A common question we receive about Form 3520 is how to report foreign gift tax on IRS form 3520. Person receives a gift from a foreign person that meets the threshold for filing the US.

Has no tax authority over the foreign person. While foreign gift tax may not be due by the donee a foreign person gift does have a disclosure requirement to the IRS if it exceeds certain thresholds. You are able to file a joint form with your spouse if.

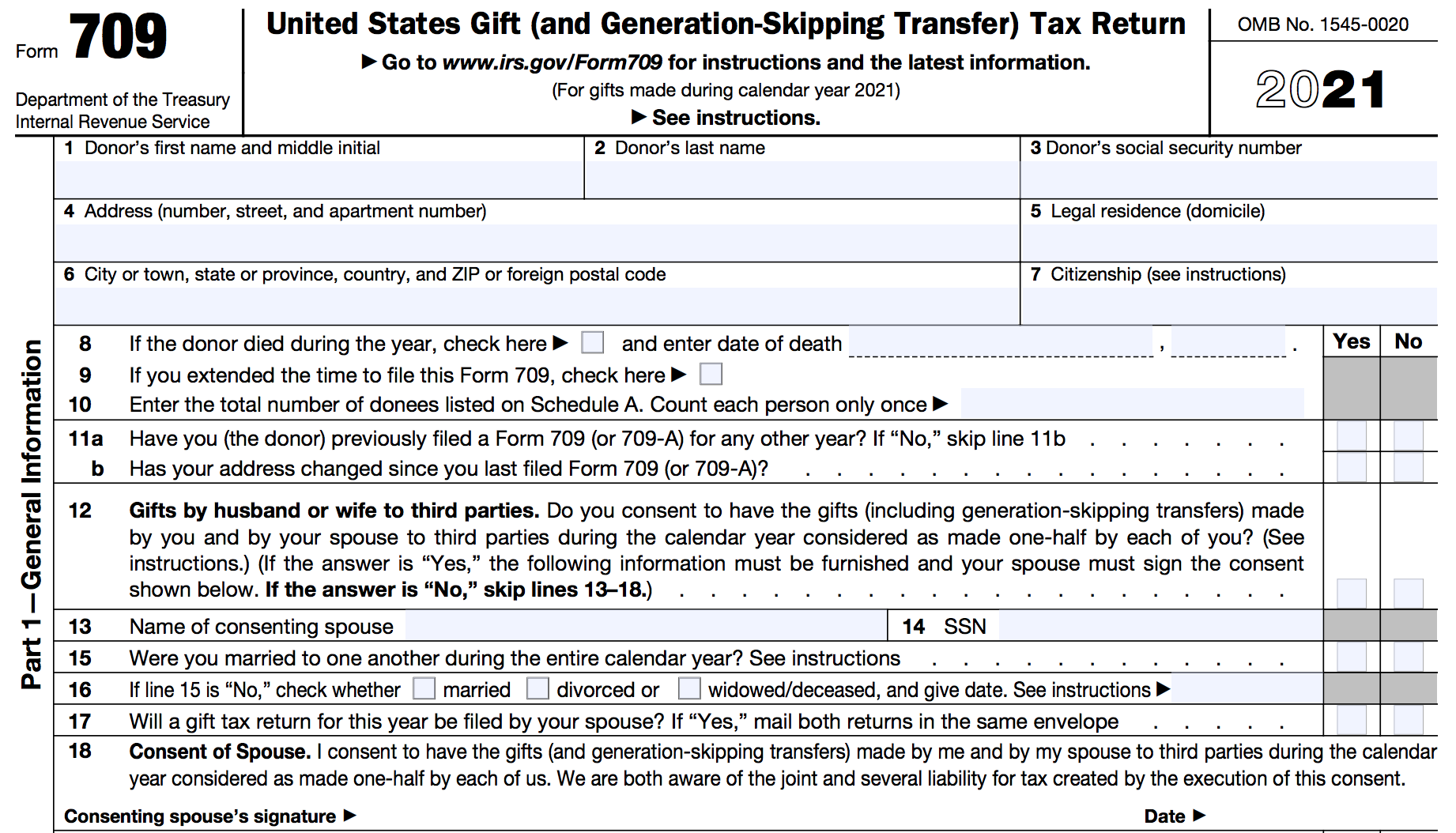

Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion. If you are a US. Learn How EY Can Help.

Consulting and Scalable Services to Help Businesses with Foreign and International Taxes. If you fall within these reporting rules you are required to file Form 3520 Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts The. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and.

Reporting a Gift from Foreign Person Form 3520. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of. Ad Helping Businesses Navigate Various International Tax Issues.

About Form 3520 Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. Person to file a. The IRS states in the opening paragraph in this publication that if you are a US.

Citizens accountable for their annual excludable amount of 15000 and lifetime gift and estate tax exemption of 114 million. As a result the person giving the gift files a gift tax return. This value is adjusted.

Taxpayer receives a gift from a foreign person trigger an international tax filing requirement. You must individually identify. For gifts from foreign corporations or foreign partnerships you are required to report the gifts if the gifts from all entities collectively exceed 16388 for 2019.

Person receives a gift from a foreign person that specific. Foreign Gift Tax the IRS. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520.

The purpose of Form 3520 is to be an informational return that is included with your personal income tax return. Person receives from that nonresident alien individual. This event triggers the requirement to file form 3520.

Form 3520 is an informational return similar to a W-2 or 1099 form rather than an actual tax return because foreign gifts themselves are not subject to income tax unless they. The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and. In addition gifts from foreign corporations or partnerships are subject.

Person must r eport the Gift on Form 3520. The gift tax return exists to keep US. For the same reason if you.

If an automatic 2-month extension applies for the US. In other words if a US. Certain events such as when a US.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

3 21 19 Foreign Trust System Internal Revenue Service

Form Gift Tax Form Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

3 21 19 Foreign Trust System Internal Revenue Service

Gifting Money To Family Members Everything You Need To Know

Gifts From Foreign Persons New Irs Requirements 2021

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Gifts From Foreign Persons New Irs Requirements 2021

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

3 11 106 Estate And Gift Tax Returns Internal Revenue Service